Guest Post by PlanetNL

PlanetNL2 – Muskrat Will Cause Monumental Government Debt and Social Pressure

PlanetNL2 – Muskrat Will Cause Monumental Government Debt and Social Pressure

In last

week’s inaugural PlanetNL, the post-Muskrat rate hike was predicted to rise quickly

into the 30-35 c/kWh range and then to continue to spiral upward as the market

continually fails to deliver required revenue.

This pricing model should be considered theoretical because it’s too

insane to think the Government would actually allow rate runaway to happen and

not attempt to intervene with a better alternative that can preserve stability

of the market and the survival of the utilities that serve it.

Logically,

Government must limit rates to some sustainable level that ratepayers can

bear. They must also not allow the bankruptcy

of NL Hydro and the Nalcor companies as this would lead to the evisceration of

core Government assets to outside interests.

Government has

little choice but to lean heavily on the public purse of the taxpayer to make

up the shortfall in utility revenue.

Government

has the exclusive authority to decide what rate the market might reasonably bear

and then accept that the difference must be provided by an operating subsidy. Two months ago, Premier Ball indicated in an

article published by The Telegram that his Government is aiming for a domestic

rate of 17 c/kWh and he acknowledges a $400M deficit that Government will have

to pay. A link to the article is

provided below in the References section.

The 17 c/kWh

level is still 70% higher than rates of recent years and sure to cause

substantial energy sales contraction as consumers of all types adapt by

reducing consumption and fleeing to non-electric or highly efficient electric heating

options. As explained in PlanetNL1, NL

Hydro production and sales would likely plunge from 7000GWh to 5000GWh thereby

eliminating any domestic demand for Muskrat Falls power.

Allowing

that industrial customers will get negligible increases on their already deeply

discounted rates, the total island system utility revenue will rise from $700 M

to about $800M.

This

increase of merely $100M will come into effect with the proposed 13% Hydro rate

increases in 2018 and 2019. Revenue

growth from rate increases will be effectively exhausted before Muskrat

start-up in 2020. Muskrat payback shall

evidently be allocated 100% to Government.

Measuring the Revenue Chasm

The required

utility revenue inclusive of Muskrat payback was shown in PlanetNL1 to be at

least $1350 and possibly up to $1550M even with Holyrood fuel savings factored

in. Choosing a value in the middle at

$1450M and then subtracting the maximum realistic ratepayer revenue amount of $800M

leaves an annual shortfall of $650M.

To reduce

this deficit, the NL Hydro and Nalcor electricity lines of business will be

asked to look inside their operations for opportunities to reduce costs or

raise revenues in their other markets. Labour

costs will be the biggest target with possible tactics including a salary

freeze, wage rollbacks and some layoffs or attrition through retirements. As over 90% of Hydro revenue occurs in the

Newfoundland island market, little will be gained by attempting to raise rates

elsewhere.

In total, Hydro

and Nalcor could scrape together at most a few tens of millions in operational

savings and revenue adjustments leaving Government to face a minimum subsidy in

2021 of $600M. How then does Premier

Ball have it measured at $400M?

Giving Up Dividends

Nalcor has a

formal 50-year Muskrat operations cash flow forecast of all dividend income anticipated

to be delivered to Government as return on equity: this document, updated by

Nalcor since the June 23, 2017 Muskrat project update, was recently obtained

through a Request For Information (ATIPP) - a link is provided below.

Before

assessing the expected dividends, recall that the Muskrat project was initially

promoted to the public as a project ratepayers would affordably pay the entire

cost of through reasonable and fair rates while the export cash flows were

supposed to be the gravy that would make Government rich.

In the first

instance, ratepayers will not find 17 c/kWh affordable and fair. It will be the highest electricity rate in

the country. In the second instance, in the

first year in which payback is required, 2021, the total dividend estimate of

$185M is not especially rich. It’s barely

1.5% on total capital and just 4.6% on the Government’s $4.0B in equity. These are unimpressive returns.

What’s worse

is that Premier Ball seems to be indicating that his Government will decline to

accept the dividends – this appears to be how he limits the required subsidy to

$400M. Reading deeper between the lines,

if no earnings are returned from the project, there will never be payback on equity:

Premier Ball is tacitly acknowledging that Government’s

$4.0B equity investment is going to be a complete loss.

Readers are

cautioned that while the forecast of dividends does show substantial earnings

increases over time, which may encourage them to think the subsidy is

temporary, be aware that the Muskrat Power Purchase Agreement (PPA) payments are

rigidly set to escalate at a near identical rate. If electricity rates are to be held to

inflation to protect ratepayers, the higher dividends are needed to meet the higher

PPA payments. The $400M subsidy is

likely a permanent requirement.

Mega-Debt: The True Cost of Muskrat

The Province’s

$4.0B equity investment has bigger problems than just being written off without

payback, as terrible as that is.

Government

is already deeply in debt and the Muskrat equity has been issued by increasing

government long-term debt. During the project

construction period, this debt adds new interest costs on itself – more money

is then borrowed to cover these interest costs. By the Muskrat start date in 2020, the

cumulative interest cost on the Muskrat equity is likely to be in the

neighbourhood of $500M.

This $0.5B extra

cost within the Treasury is a nasty hit but there are far more costly burdens

waiting to happen. Absent dividend

income to pay back the equity investment, a complacent Government will simply

borrow more money to pay the subsidies and the growing annual interest costs.

Long-term financing interest cost sensitivity is huge. The difference between the interest and

inflation rate is key to estimating overall present value costs and while

presently the Province’s credit rating may allow it to borrow at the low end of

the interest spectrum shown, the premium over inflation will rise substantially if the credit rating

declines as it surely will.

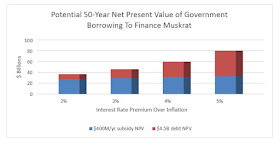

The chart

following summarizes the estimated present value of the subsidy and the lost

equity. The low end 2% interest premium

range is not truly credible for the long haul.

A net loss of $50B or greater would be quite possible.

Severe

Societal Consequences

The impact

on the Province and all citizens of a $50B loss is largely beyond the scope of

this analysis. One thing is for sure: other program spending in all Government line departments will be

severely squeezed.

Government can’t go on as the big spender and the big borrower. The Muskrat PPA and contracts are entirely inflexible – Government must contribute whatever subsidy is required or else default and lose everything. A Government committed to subsidy will instead look at its spending and would be compelled to slash and burn everything else and raise taxes and fees to untested levels.

Government can’t go on as the big spender and the big borrower. The Muskrat PPA and contracts are entirely inflexible – Government must contribute whatever subsidy is required or else default and lose everything. A Government committed to subsidy will instead look at its spending and would be compelled to slash and burn everything else and raise taxes and fees to untested levels.

The implications

are overwhelming and public consideration of such a severe worst-case scenario

is rare. Attempts were made to write

about it here but deleted – the consequences are inconceivably terrible and

there would be better authors to prepare such an overview. As it is not the recommendation of PlanetNL to

go down the road of operating subsidies, it makes little sense to write about

how terrible that might be anyway.

As very

capably detailed by a recent report of MUN’s Harris Centre, the province

already faces tremendous challenges with aging demographics and the expected population

decline of rural regions (both will contribute to energy sales decline by the

way). Those challenges multiply under

the weight of long-term Muskrat subsidy and loss even if not to the magnitude

of $50B if a loss-saving intervention should occur to the project.

The Harris

Centre researchers might wish to consider revisiting its models in their next

revision to include a considerably harsher economic scenario than they have

allowed for. One key area to explore is the

effect on the Avalon where presently they presently predict modest growth in

the next two decades. As the center of

Government and the principal economic region it stands to reason that it would

have the most to lose when Government is forced to enact harsh budget austerity

measures to slow the growth of debt. The

Avalon region could conceivably suffer the worst impact of all if the

researchers input the appropriate variables into their model.

Final Scene

Completion

and operation of the Muskrat project ends in two alternative outcomes.

The first is

overwhelming pressure on ratepayers leading to the bankruptcy and loss of NL

Hydro and all Nalcor-LCP subsidiaries and their assets – a terrifying prospect

in itself.

The second

is long term operating subsidy leading to the horrifying financial ruin of the

Province and many of its people.

Neither can

be allowed to happen.

The real

alternative needing urgent consideration is how to end this useless nightmare of

a public utility project.

Next Post

The complete

financial write-off and cancellation of the project is presented. It’s no free ride but it’s the least worst

alternative.

References and Reading Material

Muskrat

Falls Project, Sources and Uses of Funds, Issued by Nalcor, August, 2017 (see image file below)

ATIPP RFI Dividend Forecast, Issued by Nalcor, Aug.31, 2017 (see Response to ATIPP Request PB/555/2017 file below)