Guest Post by David Vardy

The Economics of Muskrat Falls (Part II)

This post builds on Part I entitled Will Muskrat Falls Pay Dividends? (Part I) which was published on Thursday,

November 8, 2018. That post is

recommended reading for this Part II.

I have attempted below to examine the likelihood that Muskrat

Falls will cover all of its costs. To make this assessment I have used the

“revenue requirement” projections supplied by Nalcor in response to my

ATIPPA request for each component of the project, along with the return on

equity assumptions used by Nalcor. The return on equity (ROE) for generating assets is 8.4% and is

built into the PPA for 50 years.

I have attempted below to examine the likelihood that Muskrat

Falls will cover all of its costs. To make this assessment I have used the

“revenue requirement” projections supplied by Nalcor in response to my

ATIPPA request for each component of the project, along with the return on

equity assumptions used by Nalcor. The return on equity (ROE) for generating assets is 8.4% and is

built into the PPA for 50 years.

For transmission assets the ROE is linked with

the return allowed by the Public Utilities Board (PUB ) for Newfoundland Power (NP) which is currently 8.5%, even though the

Labrador Island Link (LIL) is not regulated by the PUB. My analysis is

summarized in Chart 1 below.

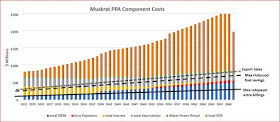

Chart 1

The chart tells the story. Operating and maintenance expenses

are shown in blue; those expenses must be paid to keep the operation alive.

Interest expense is shown in yellow; it must be paid to the bondholders on a

regular basis. Depreciation expense, shown in grey, is a mechanism for

recovering sufficient reserves to replace the assets over time. Depreciation

for Muskrat Falls is unlikely to be recovered through rates since the grey

bars, in the early years, lie above the revenue line (the double broken line

marked “Export Sales”. That essentially means that payment of principal will be highly unlikely, without the funds necessary to redeem bonds when they come payable at the end of their term.

The return on equity is shown in orange; this return must

cover the cost of the debt borrowed by the province to invest in the

project. The return on equity in excess

of interest expense incurred by the province, if there is any "surplus over interest expense", on debt borrowed by the province can be paid to

the province as dividends.

The total height of the columns represents the “revenue

requirement” or the amount of money needed to be raised each year to pay for

Muskrat Falls; it does not include the costs of the existing system the costs incurred by Newfoundland Power and NL Hydro amounting to about $700 million. In 2021

the total incremental cost shown is over $800 million.

Chart 1 also shows a solid black line labelled “Max ratepayer extra

billings”, which is an estimate of the revenue from Muskrat Falls based on

rates increasing by 50% and an assumed elasticity of -0.4. The broken black line labelled “Max Holyrood

fuel savings” shows the estimated revenue plus expected fuel savings.

The

inclusion of modest export revenues is shown by the broken parallel black lines

labelled “Export Sales. Fuel savings are estimated by the undersigned while

export revenues are in line with projections provided by Nalcor. If both are

added to revenues from rates then some of the interest expense will be

recovered but no revenues will be available to cover depreciation costs (until

the latter part of the 50 year period) or to pay a return on equity.

The

distance between the broken parallel black line labelled “Export Sales” and the

top of the bar is the deficit. The deficit begins at $500 million in 2021 ($800

million in revenue requirements less $100 million revenue from rates, $150

million from fuel savings, and $50 million from export revenues) and rises continually over the 50 year period.

Nalcor’s cost projections defer payment of the return on

provincial equity of equity payments in order to avoid rate shock. Accounting for provincial

equity in generation assets is based on “escalating supply prices” using the

PPA approach instead of the traditional "cost of service" approach. The result of

this is to maintain the real cost of energy over 50 years so that the cost per

kwh remains constant in real terms. The total revenue requirement from Muskrat

Falls rises from $800 million in 2021 to $2.6 billion in 2069. This is shown in

Chart 1 above in the total height of the columns. In nominal terms the revenue

requirements for the 50 year period total $78.5 billion dollars.

In contrast, if cost of service accounting, which is the more

generally accepted method of accounting for utility capital expenditures, were

used, the cost per kwh would decline over time in real terms as would the revenue requirements.

The deficit is shown below in Chart 2. In nominal dollars the

deficit rises to a peak of $1.8 billion. Shown in 2021 dollars, it peaks at

$700 million. This deficit represents losses or “negative dividends”!

Dividends

Payment of interest on debt is the first claim on revenues

after O & M; the payment of dividends, as the last claim on revenues, will

not be achieved. The province will instead be compelled to write off its equity

and forego dividends.

In this analysis dividends represent a part of ROE and are a

cost to the project. The cost of debt capital is less than the cost of equity

capital because it does not have to compensate for the risk which equity

investors must bear. This is measured through a “risk premium”, which is

approximately half of the 8.4% cost of generation equity and the 8.5% cost of

transmission equity. Public utilities try to maintain a balance between equity

and debt capital whereby equity capital is kept to an amount no greater than

25% - 35% of overall capital; they do this so as to minimize the overall cost

of capital.

In the case of the Labrador Island Link (LIL) the equity

component is 25% while for generation assets the equity component is 35%,

raising the cost of equity by 40% for generation. This reflects the perception

that LIL assets are less risky than the Muskrat Falls dam. This higher equity

component magnifies the impact of back end loading of the ROE for generation

assets. In simple terms, the PPA (or escalating supply price) approach defers a

large amount of the cost of equity capital to future generations to avoid

immediate rate shock. Believe it or not, if the traditional cost of service

approach had been adopted, along with full rate recovery, the 2021 rates would

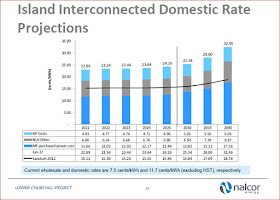

be much higher than the 22.89 cents reported by Stan Marshall in his February

2018 update shown below in Chart 3.

Chart

3

This would have had an enormous impact on consumers even if

the rate elasticity of demand were a modest -0.4%, which is the average rate

shown in many demand studies. Chart 4 below, taken from Marshall’s February

2018 update, was based on a “target” retail price (HST not included) of 18

cents per kWh as shown in the footnote to Chart 4, shown below. Chart 4 shows

significant reduction in Nalcor’s February 2018 projections, including a slight

dip, compared with the projections used at the time of project sanction and yet

are probably still too high to reflect fully the impact of demand elasticity.

Chart 4

Chart 4

Conclusion

• Q1: Is Muskrat

Falls self-supporting? No, rates will not recover costs.

• Q2: Will

Muskrat Falls generate dividends for GNL? No, it will generate losses not

dividends.

• Q3: Is the

Power Purchase Agreement appropriate collateral for this project? No it is an agreement between two related Crown Corporations whose purposes are

inconsistent and inimical to the public interest.

David Vardy

_______________________________

Note: This post is a variant on a power

point presentation I made to the Muskrat Falls Symposium hosted by Memorial

University on September 29, 2018. I want to acknowledge the help which PlanetNL

gave me in preparing this analysis but I remain fully responsible for any

errors it may contain.