A convoy of

fuel tanker trucks are seen heading out from the Come By Chance Oil Refinery to

the Holyrood Generating Station. The cavalcade persists 24 hours per day; day

after day. Their mission: to rescue the electrical grid of the Avalon Peninsula

from collapse.

Nalcor has

already planted its preferred narrative with the media: historically low

reservoir levels have imposed a higher demand on Holyrood for power than ever

before.

Yet, there

is a larger narrative at play, one that depicts the parade of tankers as proof,

as much as metaphor, of failed energy policy, incompetent operators of the

province’s electricity assets, and a group who play fast and loose with the

truth.

Unfortunately,

that is not obvious to the Consumer Advocate; but he will be dealt with in a later post.

Nalcor is

seeking approval from the PUB to levy $33.3 million on ratepayers for the cost

of thermal (diesel) generated “stand-by” power. This is power supplied by thermal plants other than Holyrood, which are called upon when Holyrood can’t meet demand.

Nalcor states

that “the amount of diesel fuel consumed could be material, as high as 215

GWh…” compared with a forecast of 11.3 GWh.

Justification

for the claim is described in Part 4 of its PUB Application:

The rate

hike request, called the 2016 Standby Fuel Deferral Account for Fuel Consumed in Combustion Turbines and Diesel Generators Application, also claims:

- · Hydro’s Reservoir Storage is at 48% and is the lowest level since 1993…recent inflows into Hydro’s reservoirs are lower than the three driest years on record: 1959, 1960, and 1961.

- · Additional thermal generation required to offset low hydrology for the remainder of 2016; approximately 1,100 GWh.

- The Holyrood component of the 1,100 GWh is estimated at 900 GWh bringing the 2016 total production at Holyrood to 2,599 GWh, which is more than 200% of its recent average annual output.

- Hydro relies on precipitation to maintain and fill its reservoirs…energy storage has materially declined since September 1, 2015. Currently, reservoir storage is the second lowest level in 24 years…September to December 2015 inflows which were 24% below average and year to date 2016…26% below average.

And

there is much more data missing from its Application. The Company doesn’t talk

about the impact of unfettered growth in demand either, which is likely helping drain

the reservoirs in advance of the winter season.

Apart from hydrology, Nalcor is also blaming demand

growth, and the bundle of bolts, referred to as the Holyrood Thermal Generating

Station (TGS), the failure of which has led to the additional requirement for standby power purchases.

But hold on.

Unless the

hydrometric data available on the Government of Newfoundland and Labrador’s Web

Site, showing Real Time Data is wrong, Nalcor’s hydrology numbers don’t hold up.

The following Real-Time Hydrometric Graph shows precipitation data for the area around the

Car Arm Reservoir, a significant source of hydro power. The time parameters cover a period longer

than the one for which Nalcor claims low precipitation. The period shown in the Graph is August

2014 to February 2016. Changes in precip are consistent with last year.

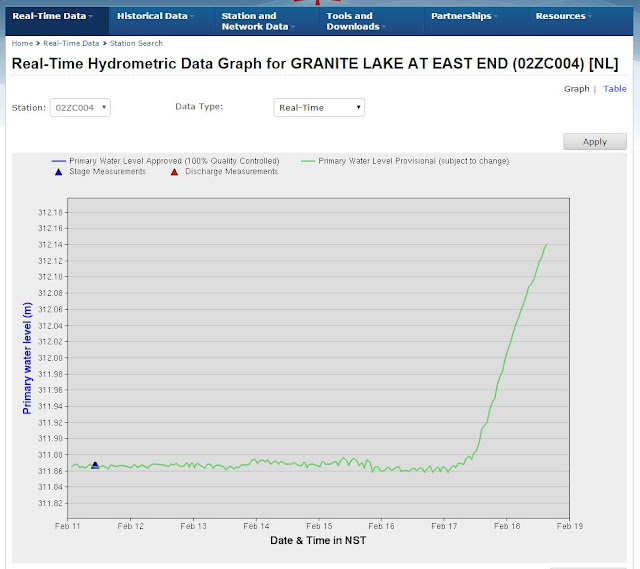

Next, let’s

look at Granite Lake for the period February 12-19, 2016. Recent precipitation in the area suggests Bay

d’Espoir should be a very wet place

.

.

But the Data Graph that gives additional truth to the other two, is shown below. Again the Graph records precipitation for the region near Granite

Lake, a major water shed for the Bay d’Espoir Hydro reservoir. The snapshot period is August, 2014

to the present. The elevations shown on the left of the exhibit indicate a record of consistency of precipitation that is quite

striking.

You would have to ask: what’s the problem? In fact, you can review the hydrological data for a variety of regions from which NL Hydro reservoirs are filled. The data is strikingly consistent over a long time and suggests no major alarms are warranted even now.

You would have to ask: what’s the problem? In fact, you can review the hydrological data for a variety of regions from which NL Hydro reservoirs are filled. The data is strikingly consistent over a long time and suggests no major alarms are warranted even now.

Indeed, if all this hydrology stuff is boring you and you need a good laugh, let me take you back just a couple of years when the Vice President of Nalcor was sitting at a Technical Conference of the UARB in Nova Scotia teasing them with 1.2 TwH per year of cheap electricity, in addition to the Nova Scotia Block get them on-board and sanction the Martime Link. This is what Paul Humphries had to say:

"....based on our over 60 years of hydrology record, we are confident that we will have available on average in excess of 1.2 terawatt hours per year...." He continues: "...in conclusion while the energy is variable it is predictable and we do have 60 years of record that gives us the confidence that it will be available..."

Suddenly, Nalcor can barely fill a tea cup!

Nalcor has not made the case, certainly not in this Application, that hydrology is the reason the reservoirs are low.

Of course,

the claim is only one of several that undermine the

legitimacy of Nalcor’s PUB Application.

Growing Customer Load

Nalcor says the increase experienced from 2010-2015, in Island Peak Demand (17%) and on the Avalon (16%) couples with an

increase of 21% in Total Annual Energy consumption.

The PUB is expected to accept the information on its face since no other context is provided.

Yet, the data represents a problem characterized by power demand that has been allowed to run rampant, as thermal generating assets are permitted to deteriorate. The following Chart 2 is reproduced from page 6 of Nalcor's filing.

The PUB is expected to accept the information on its face since no other context is provided.

Yet, the data represents a problem characterized by power demand that has been allowed to run rampant, as thermal generating assets are permitted to deteriorate. The following Chart 2 is reproduced from page 6 of Nalcor's filing.

The Graph is unmistakable evidence of the consistency of year-over-year increases both in energy

consumption and in peak demand.

In 2002, the Tobin Government extracted a deal from Vale to build a nickel smelter in the Argentia area. The power commitment based upon hydromet was for 94 MWs.. The province certainly needed the jobs but they came at a high cost, and not just to Vale. NL Hydro did not have surplus power capacity to sensibly

make that offer.

The Vale deal was reconfirmed by the Williams' government in 2008. By then Abitibi in Stephenville was permanently shuttered and in 2009 Grand Falls Abitibi followed suit. Secure power for Vale was available but only if Nalcor built the third transmission line from Central Newfoundland to the Avalon to open the "choke" created by the current two line system and to all those megawatt hours of power being spilled in the very same reservoirs Nalcor tells us are running dry. But Nalcor withdrew, not once but twice, an Application submitted to the PUB for approval to build the 3rd transmission line; the second time to free up the schedule for Hearings on Muskrat Falls. No additional Application was filed.

Back in 2011, a Nalcor Submission to the PUB contained this claim:

The Vale deal was reconfirmed by the Williams' government in 2008. By then Abitibi in Stephenville was permanently shuttered and in 2009 Grand Falls Abitibi followed suit. Secure power for Vale was available but only if Nalcor built the third transmission line from Central Newfoundland to the Avalon to open the "choke" created by the current two line system and to all those megawatt hours of power being spilled in the very same reservoirs Nalcor tells us are running dry. But Nalcor withdrew, not once but twice, an Application submitted to the PUB for approval to build the 3rd transmission line; the second time to free up the schedule for Hearings on Muskrat Falls. No additional Application was filed.

Back in 2011, a Nalcor Submission to the PUB contained this claim:

By 2015, electricity demand on the island is expected to reach the same

level as 2004 when we hit an historical peak in electricity use, and it will

continue to grow from residential, commercial and industrial electricity usage.

Almost all extra load growth on the island from today, including the

addition of Vale Inco’s large industrial load at Long Harbour commencing late

in 2011, will cause Holyrood output to once again increase. The Long Harbour

hydromet plant at full load in 2016 will require the burning of an additional

1.1 million barrels of heavy fuel oil at the Holyrood thermal plant every year

under normal hydroelectric production conditions.

Nalcor can’t

claim it did not foresee an

increased reliance on thermal assets. But the Vale decision was useful because

it helped bolster the claim Muskrat Falls was necessary. Nalcor then proceeded

to make an impending supply problem even worse.

Chart 2 (above)

constitutes a perfect overlay for an Exhibit that shows the growth of

residential construction, in recent years. During that time, as now, electric baseboard heaters were the primary heating source in over 90% of

new homes.

Are you

sensing, as I am, why Hydro’s reservoirs might be experiencing low water levels?

_______________________________________________________________

Related to this post:

UNCLE GNARLEY: TROUBLED WATERS: NALCOR SPILLS $MILLIONS

______________________________________________________________________

Related to this post:

UNCLE GNARLEY: TROUBLED WATERS: NALCOR SPILLS $MILLIONS

______________________________________________________________________

Yet, Nalcor

took not a single measure to restrict demand growth,

even as it knew the problem was threatening the very stability of the electrical grid, especially on the Northeast Avalon.

In the face

of an energy policy, best described as incompetent, not just the former Tory

Government, but Dwight Ball and Siobhan Coady, can be heard to decry Holyrood’s

“aging assets” as justification for continuing the Muskrat Falls project. This "aging assets" narrative also permeates Nalcor rate hike Application.

Barely a

week goes by, on this blog without people, like Professional Engineer Winston Adams,

expressing frustration that Nalcor refuses to slow the average load or peak load

growth associated with new home construction.

Nalcor could have asked the government to require the installation of devices such as heat pumps (which reduce demand by over 60%) in new homes, and by differentiating electricity rates for peak and off-peak usage (an option discussed in a Paper by Memorial Economist Dr. Jim Feehan), and by providing incentives for homeowners to install a plethora of energy saving options, in all homes and buildings, as many countries and virtually every other province have done.

Nalcor could have asked the government to require the installation of devices such as heat pumps (which reduce demand by over 60%) in new homes, and by differentiating electricity rates for peak and off-peak usage (an option discussed in a Paper by Memorial Economist Dr. Jim Feehan), and by providing incentives for homeowners to install a plethora of energy saving options, in all homes and buildings, as many countries and virtually every other province have done.

In addition, it is tough

to look at the demand graph and feel anything but derision for the

policymakers whose myopic focus on Muskrat Falls inspired them to forget that the

province’s thermal generating assets would be needed for many more years.

Unplanned Generational Capability

The

following excerpts from Nalcor’s Submission to the PUB are instructive:

- “…Hydro is experiencing reduced energy generation at the Holyrood TGS in recent months due to reheater tube failures in Unit 2 requiring repairs and a likelihood of similar problems occurring in Unit 1…” (Item 4 of the Application.

- “There is a major capital project for Unit 3 in 2016 including a rewind of the Unit 3 rotor and the generator overhaul. This is in addition to normal planned maintenance outages for the Holyrood units.” (P. 7 of Report)

- “…as the Holyrood TGS reaches the end of life, Hydro’s ability to operate all units at maximum capacity outside maintenance periods is limited, based on planned and unplanned required maintenance and upgrades. This is most recently evidenced by 2016 Unit 2 unavailability.” (P.7 of Report).

- “In January 2016, Unit 2 of the Holyrood TGS experienced a number of boiler tube failures….there remains a number of tubes with wall thicknesses below optimal levels in both Units 1 and 2… Hydro does not consider it appropriate to operate Units 1 and 2 at their maximum capacities….” (P.8 Report)

In short,

Units 1, 2, and 3 at Holyrood have limited operating capacity and are

unreliable.

Little

wonder the Liberty Group, a Consultancy reviewing Hydro’s generating assets for

the PUB, reported:

“Hydro has planned its system to the same

overall standard for many decades. This standard provides for lower reliability

than what Liberty has observed in other regions of North America”. It noted

that Hydro’s plan is based upon “roughly twice” the frequency of supply related

outages than found elsewhere.”

Holyrood has

been downgraded less by age than by incompetence. As if this was not already proven, I invite the reader to see Nalcor's own estimate (Table 7 below) of the difference in cost per KWh of thermal energy produced at Holyrood vs.that produced by other stand-by sources.

Yes, a quick glance will confirm Holyrood thermal is roughly half the cost of other thermal alternatives.

Now ask yourself, if you were heading a privately owned Utility, would you have chosen to be blind to the downgrade of the Holyrood assets and risk paying twice the cost of producing power?

Next consider Table 4 (below) indicating the amount of time Nalcor has reserved to get the Holyrood assets fully operational.

I suggest not a single private sector entity would fail to cut this time in half or better, rather than pay twice the cost of electricity from another source. Likely, they would work 24 hours/day to get the more cost effective Units back into service.

Yes, a quick glance will confirm Holyrood thermal is roughly half the cost of other thermal alternatives.

Now ask yourself, if you were heading a privately owned Utility, would you have chosen to be blind to the downgrade of the Holyrood assets and risk paying twice the cost of producing power?

Next consider Table 4 (below) indicating the amount of time Nalcor has reserved to get the Holyrood assets fully operational.

I suggest not a single private sector entity would fail to cut this time in half or better, rather than pay twice the cost of electricity from another source. Likely, they would work 24 hours/day to get the more cost effective Units back into service.

Nalcor is managing our Holyrood assets as one might in countries like Haiti, the Dominican

Republic or some other third world, or failed, state. Unfortunately, Nalcor has the option of running to the PUB; it can ignore entrepreneurship and professional management.

Whether or not the

public understands the implications of what Nalcor refers to as “de-rated” assets, they need to be concerned that Holyrood will have to serve Island power needs

until 2020, at the earliest; far longer if Muskrat runs out of money, the Water

Management legal challenge is lost, or the project is delayed even longer. Then there is also the

likelihood that the PUB orders Holyrood maintained as back-up.

Four more

years is a long time to expect performance from seriously neglected assets.

Yet, Ed Martin and even the new Liberal Government have the temerity to justify

Muskrat as if neglect is all we should expect.

Could

someone tell me how you attract industry to a province struggling to keep the

lights on; one that offers, at best, a future based on double the electricity costs

available elsewhere?

But to the point, Nalcor wants the public to

pay for what is essentially a failed energy policy and failed

management. The PUB should not reward incompetence even if the ratepayer is forced to suck up the cost of the diesel fuel some other way.

There is one

final point, one inspired by a 2010 Nalcor Exhibit contained in an "Information Sheet" on the Holyrood TGS.

You will appreciate those paragons of energy forecasting as your senses go numb in the face of the frightening reality these same people write the scripts for Premier Ball, his Resources and Finance Ministers, just as they did for the Tories.

You will appreciate those paragons of energy forecasting as your senses go numb in the face of the frightening reality these same people write the scripts for Premier Ball, his Resources and Finance Ministers, just as they did for the Tories.

The Exhibit shows Nalcor’s long term projection for oil prices. The obvious implication is that, while Ed Martin and V-P of NL Hydro Rob Henderson could not see the demand increase occurring on the electrical grid daily, taking no action, they felt emboldened, nevertheless, to predict the price of oil to exceed $100/barrel well into the future. The truth is Nalcor is neither good at planning or forecasting.

The current

state of Nalcor, evidenced by the state of Holyrood TGS, in energy policy, as in the management and construction of the Muskrat Falls project, is truly a national disgrace.

For all

those reasons the PUB should refuse NL Hydro’s Application.

And, as you continue to see the parade of tanker trucks heading to Holyrood, Stephenville, and other locations which offer thermal "standby" generation, you will know you are seeing incompetence exercised in real time.

_________________________________________________________________

Editor's Note: I want to acknowledge an occasional contributor to this Blog who uses the nom de plume Agent 13, for his review of the province's hydrology data.

And, as you continue to see the parade of tanker trucks heading to Holyrood, Stephenville, and other locations which offer thermal "standby" generation, you will know you are seeing incompetence exercised in real time.

_________________________________________________________________

Editor's Note: I want to acknowledge an occasional contributor to this Blog who uses the nom de plume Agent 13, for his review of the province's hydrology data.